Solar Panel Tax Credit And Home Solar Panels

updated at : Sunday, January 22nd, 2017

Solar Panel Tax Credit and Home Solar Panel

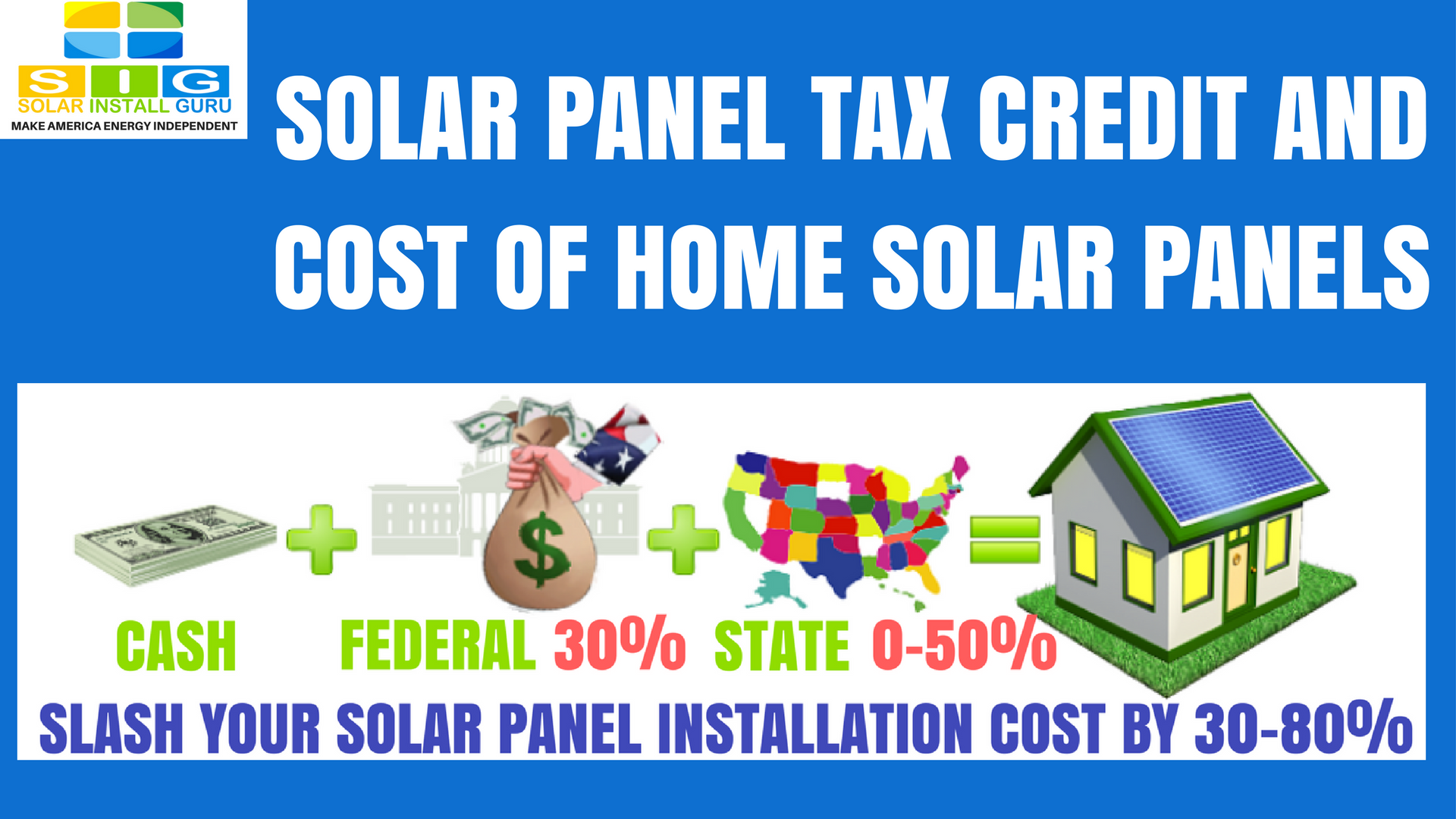

The solar panel tax credit is a government program to slash home solar panel installation costs. To qualify for this tax credit, you will need to owe federal taxes. This is because it is your tax bill that will be reduced by 30%. This policy applies to systems that are installed in existing homes, new homes being built and second homes. This credit does not apply to rental homes. Most importantly, your solar energy system must be installed in the time period when the tax credit for renewable energy is valid. The generous 30% tax credit package is to expire at end of 2016 but congress has extended it for a few years. Take advantage of the 30% solar tax credit to reduce the home solar panel installation costs before it expires.

Solar Panel Tax Credit and Solar Panel Installation Cost Related Posts:

How to install solar panels for FREE

How much does it cost to install solar panels

How to select a solar panel installation company

How to finance your solar panel installation cost with low cost financing options

How to make sure that your roof is ready for solar panel installation

How to secure low cost and long term solar panel financing with FHA PowerSaver

How to increase your property value and slash electricity bill by 90 percent without additional cost

How to choose solar panel size that will make your solar panel investment profitable

How to choose solar panel installer that will make your solar panel investment profitable

How to slash your electricity bills by 90 percent and increase your property value

How to slash your electricity bills by 90 percent with feed in tariff

how to slash your electricity bills by 90 percent with net metering

Was this post helpful? How can we improve?

WOULD LOVE TO HEAR FROM YOU!