Solar Rebates and Solar Credit Can Slash Installation Cost by 6K-12K

updated at : Thursday, December 29th, 2016

Slash your Solar Installation Cost by 80%!

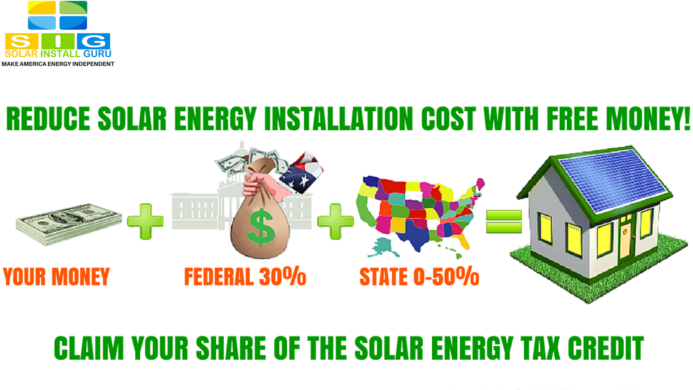

Solar rebates is an alternative energy incentive to encourage renewable energy adoption. The solar rebates vary from state to state. Some states are better than others, as far as the solar tax incentives are concerned. There are states that are offsetting as much as 50% of the solar panel installation cost and there are others who are providing very little to no credit.

Solar Rebates Benefit

Solar rebates are not universal and vary from state to state. You might live in a renewable energy friendly state where the solar rebates are high. On the flip side, you might be in a state where the solar rebates are nonexistent. The federal government gives you an automatic 30% rebate on your installation cost. This is funded by your federal tax dollars. This topic has been explained in another blog titled Federal Solar Tax Credit: Slash Solar Panel Installation Cost by 30 Percent Most if not all states are now reimbursing certain portions of your renewable energy installation cost.

If you live in a renewable energy friendly state such as California, you can find solar tax incentives such as cash back, waived fees, and expedited permits. Cumulative California solar tax incentives amount from several hundred to thousands of dollars. Many other states have generous rebate policies. In many states, these rebates climb to thousands just like California.

Solar Rebates Explained

Let’s take an example of the sticker price of $20,000.00 for a solar panel installation cost. The federal government is going to pay $6000.00 and your state solar rebate might cover 0-50% of the solar panel installation cost. Let us consider that you live in a state where the solar rebate goes as high as 30%. This means you have saved another $6000.00. The solar energy system installation cost was $20000.00 but is reduced to $8000.00 after utilizing the federal solar tax credit and state solar tax incentive. The solar tax incentives by your state play a huge role in reducing your solar panel installation cost.

Claim FREE Money Now

Not all states have embraced the renewable energy bandwagon in the same way. Some states are more aggressive than others. The residents of the states with great solar tax incentives for renewable energy, like California, are reaping the greatest benefits. Even if your state is not renewable energy friendly, you are still entitled to install a solar energy system on your rooftop and claim 30% of the federal solar tax credit. With a combination of the federal solar tax credit and state solar rebates, you can reduce your solar panel installation cost by 30 to 80 percent. Due to huge demands, the state and federal governments are cutting back and becoming less lucrative. Take steps to get your share of the FREE money from the federal and state governments before they are a thing of the past.

Solar Rebates and Solar Panel Installation Cost Related Posts:

How to install solar panels for FREE

How much does it cost to install solar panels

How to select a solar panel installation company

How to finance your solar panel installation cost with low cost financing options

How to make sure that your roof is ready for solar panel installation

How to secure low cost and long term solar panel financing with FHA PowerSaver

How to increase your property value and slash electricity bill by 90 percent without additional cost

How to choose solar panel size that will make your solar panel investment profitable

How to choose solar panel installer that will make your solar panel investment profitable

How to slash your electricity bills by 90 percent and increase your property value

How to slash your electricity bills by 90 percent with feed in tariff

how to slash your electricity bills by 90 percent with net metering

Was this post helpful? How can we improve?

WOULD LOVE TO HEAR FROM YOU!